July 22, 2021

H2O MIDSTREAM IS A FOUNDING MEMBER OF B3 INSIGHT’S OILFIELD WATER ESG COUNCIL

DENVER, CO, July 22, 2021 – B3 Insight announced the Oilfield Water Stewardship Council (OWSC), a new ESG-focused membership program for water management in oil and gas. B3 CEO and co-founder Kelly Bennett said “This program is a commitment by B3 and its members to put words to action through collaboration and transparency to create meaningful solutions.”

Water management continues to grow in importance within the oil field as well as outside of it. Permian Basin water management has increased dramatically since the introduction of horizontal drilling, from 235 million barrels of water injected in December 2010 to 669 million barrels in August 2019. Recent years have also seen increased investor and social pressure to advance sustainability in the water management industry, a market valued at $41 billion.

“Pioneer actively works to be both part of the discussion and part of the solution when it comes to water usage in the oil and gas industry,” says Mark Berg, Executive Vice President of Corporate Operations at Pioneer Natural Resources. “We employ a comprehensive, full-cycle water management strategy, and we seek to carry out innovative and forward-thinking measures for improving water stewardship. We look forward to participating in the Oilfield Water Stewardship Council alongside peers with the same goals.”

Standardized metrics, reporting, and frameworks are key to unlocking the value of sustainable water management investments. The current lack of this standardization and reporting inconsistency leaves many stakeholders without a means to compare management practices and leverage quantitative data to benchmark performance. This poses a major roadblock for companies striving to advance their ESG strategies and define responsible operating practices.

Patrick Walker, Co-Founder of Goodnight Midstream, states “Throughout the most prolific oil and gas basins in the United States, Goodnight has always believed midstream infrastructure is the future of produced water management - and the industry’s most environmentally sound water solution. We are honored to join our peers and the OWSC in continuing to elevate our sector’s ability to responsibly deliver critical energy.”

The OWSC, comprised of industry leaders committed to advancing water stewardship in the oil and gas industry, plans to tackle these challenges and create practical information and tools for the industry. B3 is incredibly proud to have this group of founding members as we set about shaping a more sustainable water management future.

The first program of its kind, the OWSC includes founding members from H2O Midstream, EagleClaw Midstream, Pioneer Natural Resources, Solaris Water Midstream, Breakwater Energy Partners, PearlSnap Midstream, and Goodnight Midstream.

For more information, visit B3 Insight launches Oilfield Water ESG Council program.

July 2021

NEW LOGISTICS SOLUTIONS REDUCE FINANCIAL, ESG COSTS OF PRODUCED WATER DISPOSAL

By Jeff O’Block and Frank Olmsted

HOUSTON, TX, July 2021 – Producers in the Permian Basin shoulder the burden of safely moving produced saltwater from producing wells to injection wells. The burden increases each day, as water-to-oil ratios (WORs) grow with every new well pad and as legacy horizontal wells journey down the decline curve.

While state regulatory reporting data for produced water is not exact, estimates suggest that the average WOR across the basin ranges between 1:1 and 4:1, with the highest ratios topping out at 10:1 in parts of the Delaware Basin. The utility of produced water is constrained by the tight rock from which it is produced, limiting opportunities to repurpose it for enhanced oil recovery and waterflooding. As a result, the bulk of Permian produced water makes its way to injection wells at varying depths for disposal. Permian water disposal is a multibillion dollar industry, and it is only getting bigger.

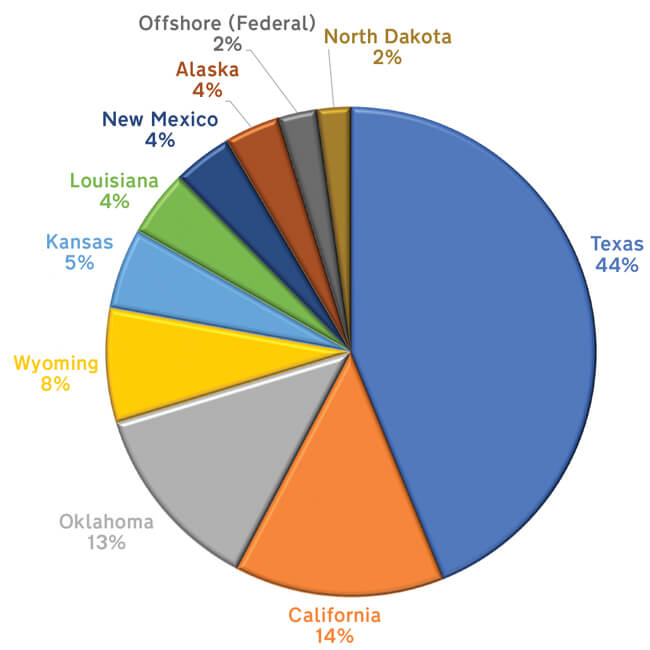

U.S. Produced Water Contributions by State (Figure 1)

Supporting the movement and disposal of saltwater is an extensive and continuously evolving infrastructure, from a labyrinth of polyethylene gathering lines and pumping stations to ever-present fleets of trucks that pack the roads of West Texas and Southeast New Mexico. Increasing production intersects with increasing water disposal costs at a point where the break-even cost for new wells may render some portions of the basin uneconomic unless the region sees a step change in how efficiently water can be moved, disposed of, recycled and reused.

For an increasing number of producers, the trend has been to jettison their water management activities and completely outsource dispatch, fleet management, and the associated general and administrative and technology costs. Instead, they are leveraging the economy of scale of midstream service providers to reduce their infrastructure capital and water management costs.

Figure 1 shows each state’s relative contributions on a percentage basis to total U.S. produced water. Not surprisingly, Texas accounts for 44% of all U.S. produced water, driven primarily by Permian Basin oil production operations.

At a time when water management and the environmental impact of oil and gas operations are receiving increased scrutiny from shareholders, capital providers and other stakeholders, saltwater disposal is linked to emissions and an operator’s environment, social and governance score. Indeed, lowering water management costs must also include lowering the environmental impact of transportation and disposal, underscoring the utility of repurposing produced water for reuse in oil and gas operations, agriculture and other applications that transform something that should be disposed of into a valuable commodity.Producers are getting out of the saltwater disposal business to reduce their costs, effectively shifting the burden of optimizing financial and ESG costs to midstream companies. How companies manage the flow of their digital systems to automate processes and generate business insights is as important as managing the physical flow of water. To this end, integrated water management companies and water carriers are deploying digital oil field strategies that reduce costs and enhance ESG for producers.

Optimizing Water Management

Consider, for example, the water management needs of a new well pad that started production in Howard County, Tx. Hundreds of thousands of barrels of water were pumped into each well during hydraulic fracturing (upward of 15 million barrels per well are pumped in some areas of the Permian Basin) on pads that generally range anywhere from four to 10 wells a pad. Much of the fluid pumped into each well during fracturing now is returning to the surface during the flowback process. This is where produced water management starts, and following initial flowback, the operator of the new well pad will need to take away anywhere from 16,000 to 48,000 barrels of water a day at its peak. With a hauling capacity of around 200 barrels per truck, it would take up to 240 trucks a day to haul the produced saltwater away.

Pipelines offer the most efficient method to transport water to disposal wells, efficient being defined as matching the peak takeaway capacity demand as well as the lowest cost for producers. Furthermore, these solutions minimize or eliminate completely the need for trucks, improving environmental and safety benefits.

Constructing water pipeline infrastructure is a capital-intensive process, so one of the first areas to reduce risk and protect capital investment is through acreage dedication agreements between midstream companies and producers. Integrated water midstream companies–who manage the complete process of gathering, transporting and injecting water back into the ground or recycling and redelivering it–have multiple paths to manage their costs.

Like producing wells, injection wells carry a royalty burden. Optimizing costs can be achieved quickly by moving water around the system to inject it into the acreage with the lowest royalty burden. Moving water through a gathering and transportation system and pumping it into the ground also requires power, so it is also in the interest of these companies to evaluate the timing of running pumps to avoid peak power rates and minimize utility costs.

Produced water varies in its quality, and often requires expensive chemicals to treat it prior to disposal. Optimizing chemical programs can shrink expenses for these companies. Last but not least are repair and maintenance. Cost-efficient water management operations demand proactive maintenance of pipelines, pumping stations, tanks and injection wells to avoid replacing equipment and costly downtime.

To achieve these cost optimizations, integrated water management providers need robust data management and analytics, especially for measurement, contract management and the accounting movement of water through the system.

Cloud-Based Logistics

H2O Midstream is navigating water management complexity and optimizing its operational costs with a new generation of cloud-based logistics and transaction management software. The company operates one of the largest integrated water midstream networks in the Midland Basin, composed of more than 300 miles of fully integrated pipeline, 2 million barrels of storage, and access to 500,000 bbl/d of owned and third-party disposal capacity. Its logistics requirements grew increasingly complex as customer contracts tripled across the basin. At the same time, the company expanded its water management infrastructure through an acquisition in the Midland Basin and the formation of a joint venture in the Delaware Basin.

Rapid growth required the tracking of a growing number of meters and transactions spanning its gathering and transportation pipelines. Critical to its business needs was the ability to accelerate monthly volume measurement and streamline the customer invoicing process. Additionally, as its capital programs expanded, H2O Midstream needed to improve its ability to better track and report project status and better manage its increasing number and scale of projects. To optimize its costs, timely access to detailed data was critical.

H2O Midstream partnered with W Energy Software to advance digital transformation and create new cost optimization opportunities by managing measurement, logistical and transactional data in a single, unified enterprise resource planning (ERP) solution. The cloud-based ERP system enables the service provider to track complex customer contracts (including rates and escalations), aggregate and validate measurement data from over 250 meters, and accurately record transactions across its extensive produced water pipeline systems in the Permian Basin. Furthermore, the system allows for efficient scalability as the company grows, which was a critical objective of its software selection.

Because the financial accounting and liquids transportation solutions are fully integrated on the cloud, H2O Midstream’s staff no longer have to wait until the books are closed to see financial results, but can see results as soon as information is posted, providing up-to-date insights for strategic and daily decision making as well as powering analytics that help optimize field spending and capital costs. The ERP software is an integral part of the service provider’s long-term strategy to scale up and contain costs as it experiences exponential market growth.

Real-Time Solutions

Absent infrastructure, trucks remain an important part of moving produced water in the Permian and other U.S. basins. Legacy vertical wells and remote locations are out of reach of gathering systems and given the return on capital deployed for such areas, many operators prefer to mobilize people and trucks for the problem of moving water to injection wells.

Water haulers are the preferred solution down many lease roads, but the ESG impact is greater as trucks wait in line on well sites to pick up or deliver with engines idling. Drivers may take circuitous routes to well sites and travel long distances with water tanks empty (“deadhead” runs). All of this has a cost: a financial cost to the carrier in unnecessary fuel usage and an environmental cost in terms of emissions. Adding to the ESG impact are increased chances of accidents and spills.

Water haulers and pipeline operators are borrowing a chapter from gasoline distribution networks that build out pipelines to local terminals where gasoline trucks take it the rest of the way. Truck stations are playing a part in reducing emissions, but analytics can drive higher cost efficiencies by helping truckers optimize every route in real time, avoid waiting in line and minimizing deadhead runs.

Chorus Logistics is a suite of transportation solutions that have far-ranging operational and financial advantages for midstream and upstream companies. It targets efficiencies that can reduce costs profoundly, including fuel that accounts for 20% of operating expenses on average. This is accomplished by eliminating paper run tickets and connecting drivers to an automated dispatch system through a mobile app. Leveraging machine learning and smart routing technology similar to FedEx and UPS, drivers receive turn-by-turn directions to well sites and delivery points, avoiding locations where other haulers are waiting in line, bypassing traffic and optimizing fuel usage.

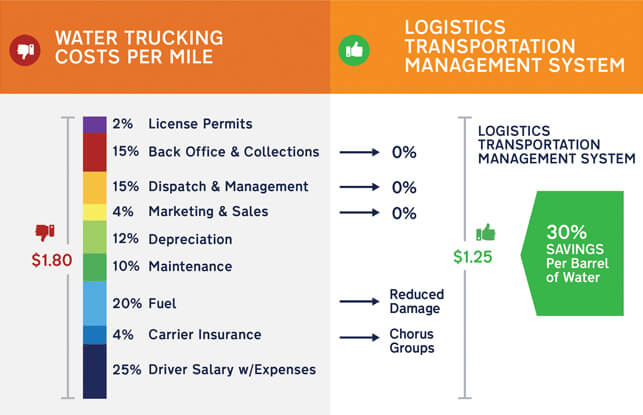

Back Office and Logistical Costs to Truck Produced Water One Mile (Figure 2)

The cost containment benefits of Chorus Logistics also extend into the carrier’s back office, where 25% of operating expenses are locked up in dispatch, collections and regulatory reporting. Invoicing procedures and getting paid in a timely manner long have forced many water haulers to factor their invoices (sell their accounts receivable to a third party for less than they are worth). Technologies such as Chorus Logistics automate invoicing for haulers and ensure rapid remittance, increasing cash flow. At the same time, requisite systems, and general and administrative to manage the back office are completely eliminated while providing additional cost efficiencies by automating marketing and sales and enabling carriers to group insurance coverage.

Optimized routes and fuel use combined with automation of the carrier’s back office can add up to a 30% cost savings per barrel of water produced, savings that translate to lower lifting costs for producers. The technology also reduces risks for all parties by allowing midstream companies to track every molecule of water and know where it is at every moment while providing producers with visibility into the movement and final disposal of resources they are ultimately responsible for. Beyond the Permian and moving water by truck or pipeline, Chorus Logistics also is enabling intermodal and cross-commodity transportation management in real time along rail, vessel and barge.

Figure 2 shows back office and logistical costs to truck produced water one mile for truck transportation versus optimized back office and fuel usage for logistics transportation management.

Commoditizing Produced Water

Produced water traditionally has been seen as a waste byproduct of oil and gas production, leading the industry to seek cost-effective ways of disposing of it. Ultimately, however, the goal is to improve the balance sheet, which can be achieved through both cost efficiency and revenue generating potential.

One way produced water has been monetized traditionally is by skimming off and marketing oil that accumulates on the surface of the water in storage tanks. Producers and midstream water companies also are recycling flowback and produced water. Once treated, produced water is returned to the producer for fracturing operations, creating a closed loop where revenue opportunities exist for disposing of and treating produced water as well as reselling water as a commodity in an arid region where freshwater is ironically scarce.

While potable water supplies continue to dwindle worldwide, the bigger opportunity for the industry, markets and the public is to reset mindsets and begin seeing oil and gas companies as a potential new source of water. Like the myth of peak oil, peak water supply is academic. When the need and economics are right, innovators will find economic ways of transforming saltwater or wastewater into drinkable or agricultural water sources, similar to the way desalination plants in the Middle East supply drinking water to cities hundreds of miles away or consistent with the current “toilet-to-tap” treatment systems provided in the sewage wastewater industry where sewage is processed and returned to lakes and re-enters the water supply.

As the oil and gas industry navigates the current push for energy transition, the calculus of what qualifies as green energy is complex. Solar panels, to cite an example, are largely made in China, and generally rely on coal-burning power generation to meet the extensive electrical requirements of glass production and panel assembly. Should our country and the energy industry continue investing in renewable energy sources at the expense of emissions and the environment? Instead, there is an opportunity to invest more in natural gas as the power source of the future and begin investing in produced water as a water source of the future. To achieve the latter will require massive investment into infrastructure and methods of automating water management, from the wellhead to city gates.

Digital Analytics and logistics management technology will continue to play a vital role in solving the produced water management challenges of today and tomorrow, driving down costs and break-even levels as well as creating new revenue generating opportunities as produced water increasingly is viewed as a commodity.

At the same time, technology and analytics-optimized water transportation and carrier operations are lowering oil field emissions, a “win” for both the bottom line and the environment. The oil field of the future might be one where we reverse the flow of injectors and transform them into producing water wells. West Texas and the desert Southwest may look greener one day.

For more information, visit New Logistics Solutions Reduce Financial, ESG Costs Of Produced Water Disposal.

Contact:

Chorus Logistics

Jeff O’Block, Founder

H2O Midstream

Frank Olmsted, Chief Financial Officer, (713) 501-8412

March 16, 2021

Jim Summers to Speak at Oilfield Water Markets Conference on May 13, 2021

H2O Midstream CEO, Jim Summers, will participate in the panel entitled “The Intersection of ESG Fund Flows & Oilfield Water Management” at 1:30 pm on May 13 in Frisco, TX.

To learn more, visit: Oilfield Water Markets